• Production cost per barrel 42% higher than estimated global average

• Production cost per barrel 42% higher than estimated global average

• One million bpd committed to IOCs, Dangote, Afrexim debt

• Forward sales to worsen dollar liquidity

• Poor earnings threaten 2024 budget implementation funding

At least over 50 per cent of what Nigeria earns from the sale of crude oil and gas is going into crude production. That translates to an average of $1.7 billion monthly for a country that is in economic mess.

Three years ago, when the cost of the production was about $20 per barrel, the Group Chief Executive Officer of the Nigerian National Petroleum Company Limited (NNPCL), Mele Kyari, launched a campaign to bring down the cost to $10 but instead of reducing, the cost has more than doubled to about $43.

The development, coming at a time when Nigeria is facing a foreign exchange (FX) crisis and looking for every avenue to boost dollar earnings, including a plan to borrow $10 billion to defend the free fall of naira, earned Nigeria one of the countries with the highest crude oil production cost.

Due to geological peculiarities, per barrel cost of oil production is highest in the United Kingdom where it stands at about $44.33 and the lowest in Saudi Arabia at $8.98. In Brazil, it is about $34.99.

In Iran, where production is the lowest cost, the figure is only $9 while it is $10 in Iraq. These put the midpoint of the global cost of producing a barrel at about $25; and the cost of production in Nigeria is about 42 per cent higher than the estimated mean.

Stakeholders had, in 2020, told The Guardian that Kyari and the oil sector were only concerned about reducing the cost of production due to the low price of crude oil in 2020 and that the campaign would become a forgotten issue as soon as the oil price rebounded. The fear of the industry players did not only come to pass but the cost of production jumped by over 50 per cent.

The situation is worsened by oil theft with the country losing over 80 per cent of production to theft if the position of former President Olusegun Obasanjo is anything to take seriously. Reflecting the worsening production, NNPC alone spent over N267.98 billion on security services in 16 months, which means the entire industry could be spending about N1 trillion on insecurity in the period.

Meanwhile, diesel which powers most oil production activities has moved from N224 per litre in 2020 to its current N1,500. Inflation has also jumped from 13.25 per cent in 2020 to almost 30 per cent in January as the value of the naira nosedive to a record low, with a serious impact on the cost of doing business.

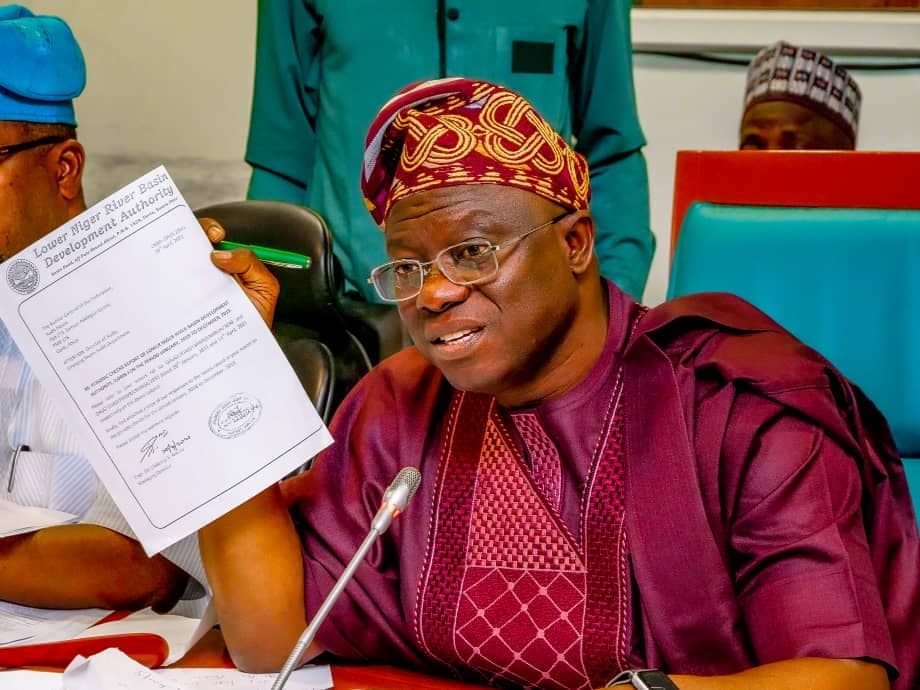

Also, the regulatory framework is now divided into two arms creating multiple taxes and bottlenecks as the complete cycle lingers than usual. Also, the policy direction through the tenure of former President Muhammadu Buhari as Minister of Petroleum Resources, a position subsequently transferred to President Bola Tinubu, did not provide the needed leadership to help the sector.

With uncompetitive personnel, logistics and handling costs contributing to the $43 production cost per barrel, a breakdown of the production sees 38 per cent going into human resource services, 19 per cent to logistics, 13 per cent to direct handling and nine per cent to direct lifting. Regulatory and other auxiliary costs contribute to the remaining cost component.

In the last 16 months, NNPC alone paid about 266 billion in overhead as reflected in the company’s audited report. The industry’s total expenditure on overhead was about N785 billion.

The entire oil industry in Nigeria, especially the upstream players should be earning about $3.5 billion monthly from oil production given that the Organisation of Petroleum Exporting Countries (OPEC) put the country’s current production at 1.419 million barrels per day (bpd), about half of the money, $1.7 billion, goes into salaries of workers, insecurity, services, bribes, payment for assets and other expenses.

For Nigeria, the situation becomes critical because apart from bloated overhead, NNPC is expected to pay approximately 600,000 bpd of crude oil to international oil companies in carry arrangements due to joint ventures debt, over 300,000 to Dangote Refinery under a forward sale agreement and another forward-sale of 90,000 bpd of Nigeria’s share of offshore crude to AfreximBank where NNPCL took $3.3 billion crude backed loan.

While Nigeria’s budget stands at N28.77 trillion, the oil price benchmark stands at $77.96 per barrel, against targeted daily production volumes of 1.78 million bpd. About N7.69 trillion of the funding is expected from the oil sector.

NNPCL engages in multiple carry agreements, such as alternative funding agreements and modified carry agreements with the IOCs. In these arrangements, the carried party, NNPCL, has its project development expenses reimbursed to the carrying party through methods like carry tax relief (CTR) and carry oil among others. The arrangements were meant to address cash call issues.

Going by the details of the 2022 audited report, NNPCL has contract liabilities of N2.615 trillion. These come from forward sale agreements, encompassing Projects Falcon, Santolina, Panther, Bison, NLNG SPDC, NLNG TEPNG and DSDP customers. The forward sales represent commitments for crude oil, where NNPCL has received value but has yet to deliver the products in exchange.

Also, while buying 20 per cent share of Dangote Refinery at $2.76 billion, $1.036 billion was paid and the rest was to be paid with the supply of 300,000 bpd.

The high cost, coupled with the continuous importation of premium motor spirit as well as the different cash and crude-backed loans mean that Nigeria has very dismal oil revenue.

A renowned professor emeritus, Wunmi Iledare, said while it is not abnormal for costs to rise in an inflationary economy because of excess money chasing fewer goods, there is a need to urgently delimit the cost of governance of the sector.

While the sector is still struggling to implement a pronounced contract cycle, Iledare said it is now very critical to shorten the contract cycle.

“Of course, there is nothing the industry can do with inefficient and inefficient monetary policy but there is much they can do if they are fiscally responsible. I also think PIA implementation follows the spirit of the law beyond the letter of the law. It seems we are back to the amorphous, overlapped, and territorial governance and institutions, which are antithetical to the core principles of the PIA institutions conceptualised to minimise costs. Regulatory institutions cannot be revenue-driven in the fashioning of regulations.

“The policy institution must be up and doing finding ways to reduce cost rather than adding cost and of course, the commercial institutions must not wear the agency role mentality with the propensity to bail out the federal government any time the latter coughs. Every penny spent including corporate social responsibility or investment comes out of the barrel,” Iledare said.

Former President of the Chartered Institute of Bankers of Nigeria (CIBN) and professor of Economics at Babcock University, Prof. Segun Ajibola said security concerns are unhelpful to the Nigerian economy as all segments of the national economy have a tale of woes to tell regarding the monstrous issue.

According to him, the Nigerian oil sector remains highly exposed to the key actors in the unholy business of kidnapping, terrorism, even as most companies have been victims of insecurity in their operating bases, especially those in the upstream sector.

“Spending on security has unfortunately become an important item in the books of almost all business outfits in the country. The nature of the operation of the oil companies makes matters worse as they find themselves amid devastated host communities struggling to eke out a living.

“Years of neglect, destruction of sources of livelihood, environmental degradation, unemployment and lack of infrastructural facilities keep fuelling youth restrictiveness in the Niger Delta. This is a major contributor to the rising cases of attacks and kidnapping hitting major oil companies in the region,” Ajibola said.

He stated that there is a need for a strategic solution to all the identified triggers in all the communities and states where IOCs operate, adding that the host community trust fund should be in place and properly implemented.

Ajibola also asked that governments at all levels use all within their arsenals to combat threats to security across the length and breadth of the country.

“Besides the security operatives, local communities must be involved in fighting this national cankerworm to protect lives and properties of all and sundry,” he said.

Industry stakeholders, Dr Dauda Garuba noted that economies of scale and corruption are fueling the crisis.

“Oil is naturally dollarised. It is bad enough that we have gone beyond dollarising anything and everything associated with oil and beyond. Until the Central Bank of Nigeria (CBN) sits up and performs its role, the situation will only get worse,” he said.

Energy expert, Dan Kunle, noted that Nigeria’s crude oil production cost per barrel is mainly influenced by security cost, adding however that the cost of money and the country’s inefficient management culture are more critical to the cost variants.

“Nigeria has a very low level of industrial engineering infrastructural facilities and has to import every component used in oil exploration and production. All these factors are the deterministic cost elements that sum up to $30 or $40 per barrel production cost,” he stated.

Kunle, who called for a change in attitude, said the communities must be informed that oil exists all over the world and not in their communities alone.

He said: “This is why the IOCs look for more competitive locations in the world to produce oil. We may also need to further open our offshore acreages with attractive fiscal policies to encourage the IOCs for more investments. This may help to reduce the average unit costs of production.”